In one of the longest Baxter County Quorum Court meetings in recent memory, the justices spent about an hour and 15 minutes Tuesday night discussing one item of business–raising the taxing rate for personal and real property by 2 mills. The lengthy discussion came despite one significant factor–no one on the court or in the audience spoke in opposition.

During the protracted discussion, it was noted the millage has remained unchanged since 1990 when the county sales tax was implemented. With the sales tax passage 29 years ago, the county general millage was rolled back from 1.8 mills. Since that time, as the cost of operation has grown, the county has relied on increased sales tax collections to cover its expenses.

The proposal to raise the county general millage rate follows a voter mandated raise in the minimum wage leading to a realignment of the wage scale, federal adjustments to the Fair Labor Standards Act and soaring health insurance costs now reaching $1.2 million annually, after having raised the deductible level three times. In an earlier interview with KTLO, Classic Hits and The Boot news, Judge Mickey Pendergrass referred to these three increases as the “big dogs in the room.”

Judge Pendergrass said the millage increase proposal primarily driven by the “big dogs” was needed despite the passage of the one-quarter cent sales tax for operation of the jail and with projects and maintenance being delayed.

From Tuesday’s meeting the justices heard the increased 2 mills are projected to generate $1.1 million annually.

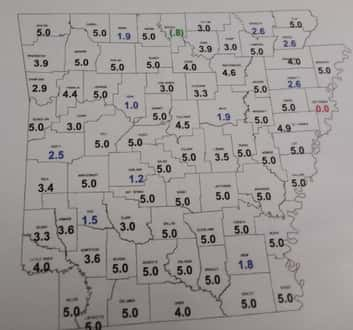

Image: Baxter is one of just 13 of the state’s 75 counties with a county general millage less than 3. Forty-one of the state’s 75 counties have the maximum of 5 mills. Source: Baxter County Treasurer’s Office

Despite some justices asking for more time to consider the request, state law requires millage rates to be set in November.

During the discussion, the court heard from Sheriff John Montgomery, Treasurer Jenay Mize, Collector Teresa Smith and Assessor Jayme Nicholson, all urging them to support the measure. Their comments mirrored those of Judge Pendergrass who said, “The last thing I ever expected to do when I took this job was ask for a tax increase.”

Mize said the county has been running at a deficit in county general ever since she came into office. She said should sales tax collections decrease, “all I can say is hang on.” She said if sales tax collections should decrease, the county doesn’t have a prayer.

Smith said many residents believe when they pay their tax bill, all the funds are going to county general, pointing out 70% goes to schools, followed by fire districts, road and bridge, Arkansas State University-Mountain Home (ASUMH), the county library and then the smallest amount of about $493,000 annually goes to county general.

Despite reservations expressed from some justices wanting more time to consider the increase and expressing reservations for supporting it with the passage of the one-quarter jail operation sales tax in 2018, the measure passed unanimously with justice Lucy Soltysik absent.

The increase is part of an appropriation ordinance levying millage rates for 2019 to be collected in 2020. The ordinance covers rates for cities, school, fire and improvement districts and the county, including the library and ASUMH. All other proposed taxing rates remain at their current levels, with the exception of the Norfork School District, where the millage increases by 3 mills to 37.39.

In other business, the county unanimously adopted revisions and additions to the personnel policy manual and confirmed Judge Pendergrass’ appointment of John Browning to the Henderson Area Fire Protection District Board of Commissioners.

WebReadyTM Powered by WireReady® NSI